UK HMRC NI38 2020-2025 free printable template

Get, Create, Make and Sign form cf83

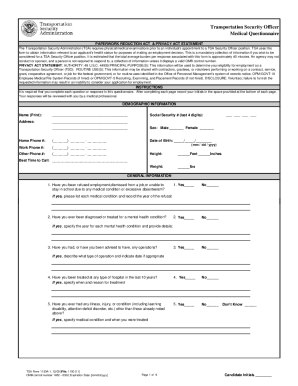

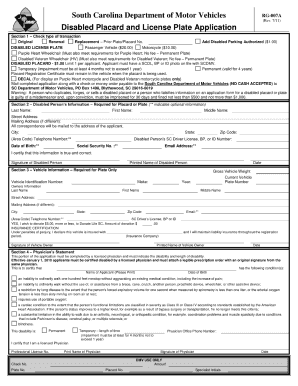

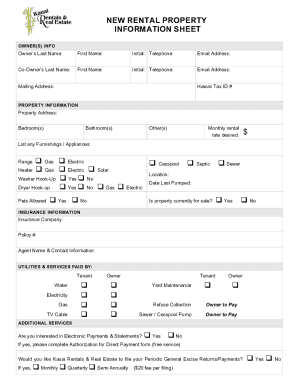

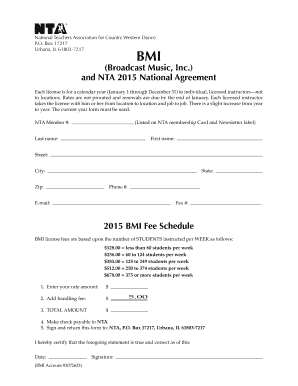

How to Edit the 2020 UK Social Security Form

UK HMRC NI38 Form Versions

How to fill out gov ni38 form

How to fill out 2020 uk social security

Who needs 2020 uk social security?

Video instructions and help with filling out and completing cf83 form online

Instructions and Help about hmrc cf83 form

You receive Wow use lots, and you receive my job being a science teacher who can't you doing experiments where we have to measure quantities of different things like length mass volume temperature using in science then where you see we make a lot of grass look a little data handling, and we have to interpret the grass and look at things like reliability bias and validity then in my job we're constantly looking at the results of pupils, and you know working at the percentage of pupils that achieved making a start or see how we need what we need to do to improve how does our how do our results compare to that of other schools so yeah we use a lot of numeracy in my job, and it's very important numeracy in technology is squared, so we do the measuring, and we don't estimate their materials how much earlier than you, we use me tools such as has been Vania and a steel ruler, and we do things like check the drillers the correct size I used numeracy and loft in my job, but specifically I use it in the school show I have to consider the profit that will make and by doing that I need to look at the ticket sales and I have to calculate how many members of the audience would give fit in the hall and then price of tickets to make sure that we cover the cost of the show I also have to think about fundraising and think about different ways that we can make money, and we also have to deal with invoices and paid deposits, and then we have to work out how much we owe companies for their sex it's part of my role as head of department I need to use quite a lot of percentages, so my big task is to analyze results and to compare all we use percentages when marking exam papers never thought I would use this little math by you that almost every day now, so I suppose in the classroom when you use math quite a lot if we're looking at things like nonfiction sex perhaps and that sort of thing and pie charts and percentages and I think we do and then with jobs as a teacher we often use math people's data, and we're trying to figure out how well they're doing we converted marks to percentages aren't we yes to people as got yep I'm in order to see progress as well you know looking at marks across the years, so we use now this quite a lot on a day-to-day basis really much a woman I would have expected when I first came into teaching as an English teacher I didn't expect to use math all the time in the way that I do know I still have to use a calculator to it well I have to say that in school my favorite subject was nuts its old that I turned out to be an English teacher, but that's the way it was I couldn't do math English and French a-levels, so Matt's had to go sad I really enjoyed if it's tidying up it's ordered its logical you know where you are with it and how do I use it in my job well teaching poetry is often like math because it is so dependent on counting and recognizing patterns and seeing cross connections it's amazing I love math I read math books in my spare time...

People Also Ask about 2020 united kingdom hmrc

What is Social Security Rate in UK?

How much does Social Security increase each year?

Can I get Social Security in the UK?

How much will my Social Security check increase in 2023?

How much does Social Security increase each year if you wait?

What is the basic pension UK?

How much is the UK pension 2020?

What was the Social Security COLA from 2020 to 2021?

How much pension do UK citizens get?

What was the Social Security increase from 2020 to 2021?

Do all British citizens get a pension?

How many years do I have to work in the UK to get a pension?

What is the average monthly pension in the UK?

What is the average Social Security check?

How much is Social Security in the UK?

What percentage did Social Security go up in 2020?

What is the Social Security amount for 2020?

How much is UK State Pension?

What did Social Security increase from 2020 to 2021?

What is the Social Security income limit for 2022?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit the 2020 UK social security form online?

How do I download the 2020 UK social security PDF?

Is it possible to print the 2020 UK social security form?

Can I collaborate with others on the 2020 UK social security form?

What should I do if I encounter issues filling out the form?

Are my personal details safe when using the form?

Can I customize the 2020 UK social security form?

Will I receive confirmation after submitting the form?

How do I get access to a fillable 2020 UK social security form?

Can I save a partially filled form and return later?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.