UK HMRC NI38 2020-2026 free printable template

Show details

Social Security abroadNI38HMRC 12/20Contents

Introduction1Information about European

Economic Area (EEA) and reciprocal

agreement countries

2

EEA2The EEA countries2Reciprocal agreement countries3National

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form cf83 pdf

Edit your cf83 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cf83 form download online

Follow the steps down below to take advantage of the professional PDF editor:

1

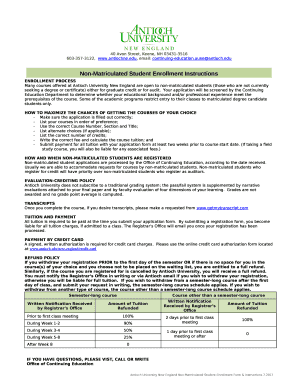

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ni38 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC NI38 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form cf83

How to fill out UK HMRC NI38

01

Obtain the UK HMRC NI38 form from the HMRC website or local office.

02

Read the accompanying guidance notes carefully to understand the requirements.

03

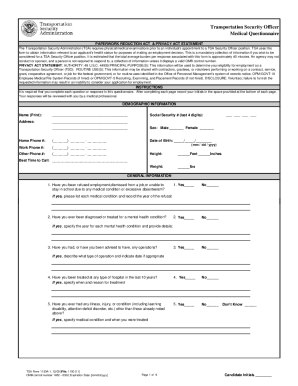

Fill out your personal details such as name, address, and National Insurance number.

04

Provide information regarding the period you are applying for.

05

Include details of any earnings or contributions made during that period.

06

State your reasons for requesting the statement of National Insurance contributions.

07

Double-check all entered information for accuracy.

08

Sign and date the form.

09

Submit the completed form to the appropriate HMRC address via post or, if applicable, online.

Who needs UK HMRC NI38?

01

Individuals who want to check their National Insurance contribution record.

02

People applying for a State Pension to ensure they have sufficient contributions.

03

Those who need proof of contributions for employment or immigration purposes.

04

Workers returning to the UK who want to track their contributions.

05

Self-employed individuals confirming their NI contributions for tax purposes.

Fill

cf83 form pdf

: Try Risk Free

People Also Ask about cf83 form online pdf

What is Social Security Rate in UK?

For the period 6 April to 5 November 2022, employers pay NIC on their employees' salary at 15.05%. Employer NIC at 15.05% also applies to benefits in kind provided to employees (e.g. company cars) as well as salary. From 6 November 2022 the amount reverts to 13.8%.

How much does Social Security increase each year?

Since 1975, Social Security's general benefit increases have been based on increases in the cost of living, as measured by the Consumer Price Index. We call such increases Cost-Of-Living Adjustments, or COLAs. We determined an 8.7-percent COLA on October 13, 2022.

Can I get Social Security in the UK?

Normally, people who are not U.S. citizens may receive U.S. Social Security benefits while outside the U.S. only if they meet certain requirements. Under the agreement, however, you may receive benefits as long as you reside in the United Kingdom regardless of your nationality.

How much will my Social Security check increase in 2023?

Social Security benefits and Supplemental Security Income (SSI) payments will increase by 8.7% in 2023. This is the annual cost-of-living adjustment (COLA) required by law. The increase will begin with benefits that Social Security beneficiaries receive in January 2023.

How much does Social Security increase each year if you wait?

Waiting to claim your Social Security benefit will result in a higher benefit. For every year you delay your claim past your FRA, you get an 8% increase in your benefit. That could be at least a 24% higher monthly benefit if you delay claiming until age 70.

What is the basic pension UK?

To get the basic State Pension you must have paid or been credited with National Insurance contributions. The full basic State Pension is £141.85 per week.

How much is the UK pension 2020?

The full new State Pension is £185.15 per week. The only reasons you can get more than the full State Pension are if: you have over a certain amount of Additional State Pension. you defer (delay) taking your State Pension.

What was the Social Security COLA from 2020 to 2021?

Social Security Cost-Of-Living Adjustments YearCOLA20191.620201.320215.920228.74 more rows

How much pension do UK citizens get?

The full basic State Pension you can get is £141.85 per week. You need 30 qualifying years of National Insurance contributions to get the full amount. You'll still get something if you have at least 1 qualifying year, but it'll be less than the full amount.

What was the Social Security increase from 2020 to 2021?

Last Updated: July 21, 2021 Approximately 70 million Americans will see a 1.3 percent increase in their Social Security benefits and Supplemental Security Income (SSI) payments in 2021.

Do all British citizens get a pension?

You usually need a total of 30 qualifying years of National Insurance contributions or credits to get the full basic State Pension. This means that for 30 years, one or more of the following applied to you: you were working and paying National Insurance.

How many years do I have to work in the UK to get a pension?

You'll usually need at least 10 qualifying years on your National Insurance record to get any State Pension. You'll need 35 qualifying years to get the full new State Pension. You'll get a proportion of the new State Pension if you have between 10 and 35 qualifying years.

What is the average monthly pension in the UK?

The actual average retirement pension income in the UK is £361 per week, which works out as £18,772 per year, or £1,564 per month.

What is the average Social Security check?

Social Security offers a monthly benefit check to many kinds of recipients. As of October 2022, the average check is $1,550.48, ing to the Social Security Administration – but that amount can differ drastically depending on the type of recipient. In fact, retirees typically make more than the overall average.

How much is Social Security in the UK?

ActualPreviousFrequency31.5527.80Yearly

What percentage did Social Security go up in 2020?

As a result, nearly 69 million Americans will see a 1.6 percent increase in their Social Security and SSI benefits in 2020. January 2020 marks other changes that will happen based on the increase in the national average wage index. For example, the maximum amount of earnings subject to Social Security payroll tax.

What is the Social Security amount for 2020?

The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

How much is UK State Pension?

The full rate of the new State Pension will be £185.15 per week (in 2022/23) but what you will get could be more or less, depending on your National Insurance (NI) record. You can check how much State Pension you could get on the government website or, you can request a paper statement if you prefer.

What did Social Security increase from 2020 to 2021?

With COLAs, Social Security and Supplemental Security Income (SSI) benefits keep pace with inflation. The latest COLA is 8.7 percent for Social Security benefits and SSI payments.

What is the Social Security income limit for 2022?

$19,560/yr. ($1,630/mo.) NOTE: One dollar in benefits will be withheld for every $2 in earnings above the limit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pay stub template canada directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your gov uk cf83 form pdf download along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find ni38 form pdf?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the ni38. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out cf83 online form on an Android device?

Use the pdfFiller mobile app and complete your cf83 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is UK HMRC NI38?

UK HMRC NI38 is a form issued by Her Majesty's Revenue and Customs (HMRC) for individuals or entities to provide details about National Insurance contributions and claims in relation to their tax affairs.

Who is required to file UK HMRC NI38?

Individuals or businesses who have made National Insurance contributions and need to claim benefits or refunds are required to file the UK HMRC NI38.

How to fill out UK HMRC NI38?

To fill out UK HMRC NI38, you need to provide personal information, details regarding National Insurance contributions, and specific claim information according to the instructions provided by HMRC on the form.

What is the purpose of UK HMRC NI38?

The purpose of UK HMRC NI38 is to ensure the accurate reporting of National Insurance contributions and to process any claims for benefits or refunds efficiently.

What information must be reported on UK HMRC NI38?

UK HMRC NI38 requires reporting of personal identifying information, National Insurance number, details of contributions made, and any other relevant information pertaining to claims for benefits or refunds.

Fill out your UK HMRC NI38 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ni38 Social Security Abroad is not the form you're looking for?Search for another form here.

Keywords relevant to form ni38

Related to cf 83 form uk

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.